Managing conflicts of interest in the workplace requires more than identifying ethical risks. It demands clear policies, structured mitigation plans, and a proactive culture of transparency that ensures every employee’s decisions align with the organization’s best interests. This article details how to manage conflicts of interest, which aren’t just theoretical risks — they’re potential operational vulnerabilities that can lead to compliance violations, lost business opportunities, and a breakdown of internal accountability.

Transparency serves as the foundation of ethical business practices. When organizations operate openly, they foster trust, reduce risk, and ensure that small ethical lapses don’t grow into major integrity concerns. Without a structured approach for how to manage conflicts of interest, even well-meaning employees can make decisions that undermine credibility and damage the organization’s reputation.

What Is a Conflict of Interest in the Workplace?

Defining Terms

A conflict of interest refers to any situation where an individual’s personal interests conflict with their professional responsibilities. It arises when personal relationships, financial interests, or outside activities compromise—or appear to compromise—an individual’s judgment and objectivity.

For instance, if you’re a researcher who consults with pharmaceutical companies about their drugs, there may be concern about your objectivity regarding related research outcomes. Similarly, if a purchasing manager has a sister who owns a business that supplies materials, choosing her company over a more qualified vendor could create a perception of bias or favoritism.

Difference Between Personal and Organizational Conflicts of Interest

Personal or individual conflicts occur when an employee’s private interests interfere with professional duties, impacting their ability to act impartially. When an employee has a conflict of interest, they are more likely to make decisions based on their own self-interest rather than the employer’s best interests.

Organizational conflicts of interest occur when the way a company is structured, the partnerships it undertakes, or its decision-making processes give rise to competing interests that compromise objectivity and ethical integrity. Examples include shared vendors, dual contracts, or biased procurement processes that favor internal affiliates.

Why COIs Are Problematic

How to manage conflicts of interest can be one of the most challenging lessons to learn in the workplace, but it is also vital to protect your company from the appearance of corruption (or actual corruption), which can be detrimental. Improper or ineffective management of conflicts of interest can lead to legal and financial repercussions.

Potential lawsuits and financial penalties due to unethical behavior or mismanagement can plague organizations, bleeding them of precious time and resources. When embroiled in legal battles, companies are subject to attorney fees and damages. Even when no unethical behavior occurs, the appearance of impropriety through apparent COIs can be equally damaging.

Harming workplace morale and creating reputational risks, COIs can result in compliance violations or a public perception of corruption. A tarnished reputation can deter stakeholders and investors. People are less likely to contribute financially to an organization with potentially corrupt leadership. Unresolved internal conflicts can lead to internal discord, decreased team cohesion, decline in productivity and turnover.

Recognizing and Preventing Conflicts of Interest

Types of COI to look out for:

Nepotism: Require disclosure of family relationships during hiring or promotions, and ensure decisions are made based on merit rather than relationships.

Romantic Relationships: Create clear policies that prevent direct supervision or evaluation of a partner to avoid favoritism or bias.

Gifts and Favors: Set firm limits on the value of gifts employees can accept and require documentation for anything that could create a perception of influence.

Self-Dealing: Establish strict oversight for financial and procurement decisions, requiring multiple layers of approval to prevent misuse of authority.

Insider Trading: Train employees to recognize the dangers of acting on confidential or non-public information and to report potential violations immediately.

Identifying Early Warning Signs

Conflicts often begin subtly—through casual favors, undisclosed relationships, or unreported gifts. Over time, if left unchecked, these small lapses can escalate into significant ethical violations. Companies that know how to manage conflicts of interest recognize patterns of favoritism, lack of transparency, or recurring vendor preference, which can help reveal hidden risks and identify conflicts before they metastasize.

Building a Culture of Transparency

“Sunlight is said to be the best of disinfectants,” wrote the U.S. Supreme Court Justice Louis Brandeis in his 1913 Harvard Law Review article, What Publicity Can Do. Just as sunlight eliminates hidden germs, transparency is the most effective deterrent against misconduct, helping to prevent unethical practices by exposing mismanagement and ensuring accountability. One might even say that building a culture of transparency is essentially how to manage conflicts of interest—at the very least, it serves as the foundation.

When decision-making is open and documented, ethical breaches become harder to conceal. Encourage open communication by establishing confidential channels for reporting conflicts, which ensures that employees feel safe to disclose potential conflicts without fear of retaliation. Reinforce the importance of reporting in protecting organizational integrity and stress that everyone plays a critical role in managing conflict of interest.

Leadership plays a critical role in shaping a culture of transparency. An organization’s ethos often reflects its top tier; leadership defines moral and ethical standards. Leading by example, executives and managers should openly disclose potential conflicts and encourage employees to do the same. When leaders prioritize ethical decision-making, they create an environment where employees feel safe addressing concerns, promoting honesty at all levels. When leadership exhibits ethical management of conflicts of interest, it significantly bolsters reputation and stakeholder trust, while mitigating legal risks.

While it starts at the top, everyone in the organization needs to know how to manage conflicts of interest. Training and awareness are critical to equip employees. Regular training sessions help employees identify potential conflicts and understand appropriate steps for disclosure. Include real-world examples relevant to different departments and job functions to improve engagement and comprehension. Emphasize that disclosing a potential conflict is a sign of integrity, not wrongdoing.

Tools and technology can and should be used to bolster transparency. Use automated systems to monitor disclosures, track compliance, and analyze potential risks. Digital solutions can streamline reporting, ensuring issues are caught early and handled consistently. Creating a culture of transparency requires both the right tools and a commitment to openness.

Developing a Conflict of Interest Policy

Purpose and Function

A COI policy provides structure and clarity, defining what constitutes a conflict and how to manage conflicts of interest when they arise. The importance of a well-defined policy cannot be overstated. Ensuring that all employees understand expectations and promoting fairness, a COI policy acts as a reference point to guide organizations in grey areas, minimize subjective interpretations, and provide consistency in conflict resolution.

A robust COI Policy contains the following key components:

- Clear definitions and examples of potential conflicts

- Procedures for disclosure, review, and resolution

- Designation of responsibility for oversight and enforcement

- Periodic review and updates to align with evolving business

Developing the Policy

Begin with collaboration among leadership, compliance officers, HR, and department heads. Collect input from multiple levels of the organization to ensure the policy addresses all relevant risk areas. Writing directives in clear, concise, actionable language makes it easier for employees to understand and follow them.

Communicating and Enforcing the Policy

Make policies easily available through internal platforms and employee handbooks. Require employee acknowledgment upon review or revision of COI policies. Include ongoing training to reinforce understanding and promote accountability. Enforce policies consistently to ensure credibility and fairness.

Creating a Conflict of Interest Mitigation Plan

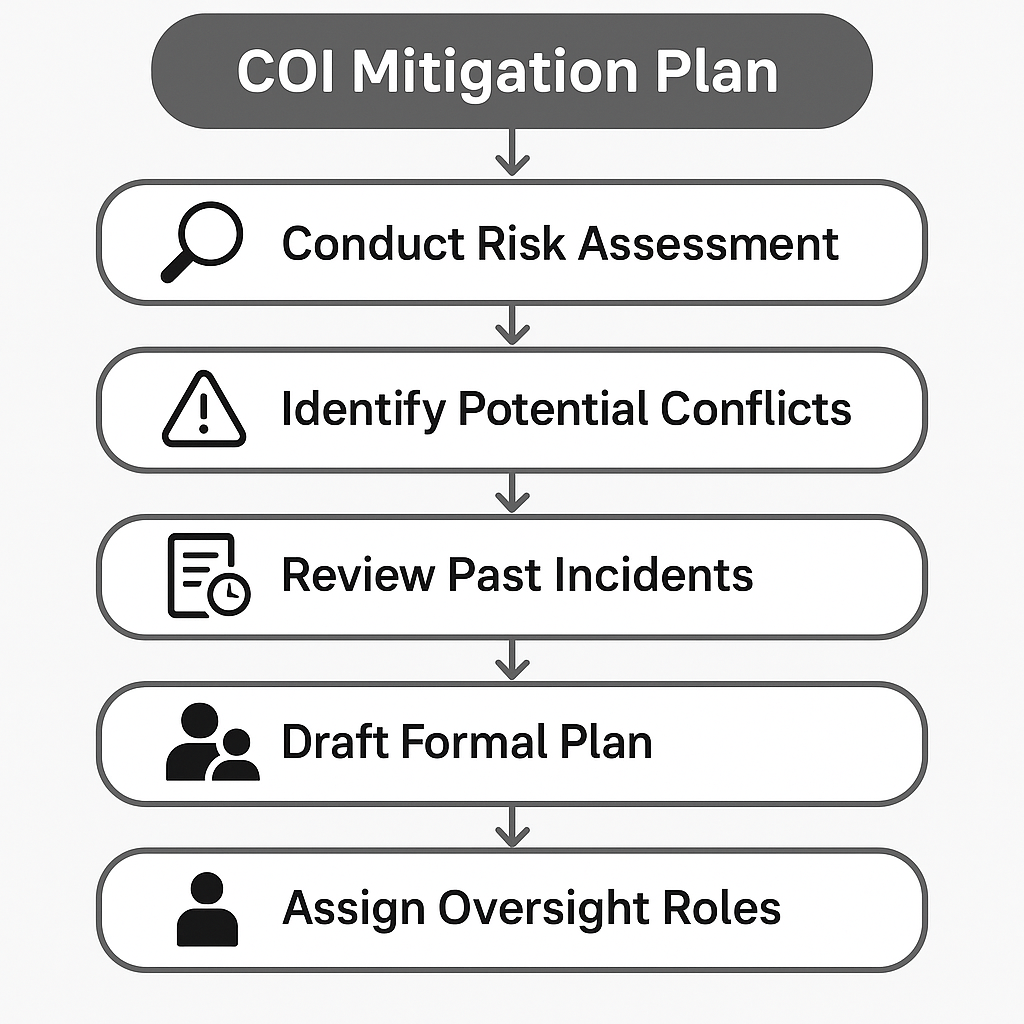

A mitigation plan ensures the organization is prepared before a conflict escalates into a compliance issue. It helps define the process for identifying, disclosing, and resolving conflicts effectively.

When seeking to reduce organizational COI, start by conducting a thorough risk assessment across all departments within the company. This assessment should aim to uncover potential sources for bias or influence. Areas of investigation may include relationships with vendors, arrangements with contractors or subcontractors, and strategic partnerships. Analyze and evaluate these factors for overlapping interests, or opportunities for insider advantages.

Don’t limit this risk assessment to current potential risk sources. Reviewing past incidents where conflicts of interest could or did arise can help identify systemic weaknesses to improve preventative measures and inform future strategies for your organizational conflict of interest mitigation plan.

After gathering necessary data and identifying potential pain points, your organizational conflict of interest mitigation plan begins with drafting a formal written plan that includes clear definitions around potential sources of and different forms of conflict, all necessary disclosure requirements, and guidance for how to manage conflicts of interest with effective resolutions. Along with outlining procedures for addressing sources of COI, be sure to assign specific oversight roles to those responsible for monitoring compliance, managing investigations, reporting and decision-making within the organization.

Managing Organizational Conflicts of Interest

Understanding Organizational COIs

Organizational conflicts arise when business structures, contracts, or partnerships create internal bias or competition between company interests. They often occur in procurement, consulting, or dual-client relationships where impartiality is critical.

Identifying Organizational Risks

Conduct enterprise-level reviews to uncover overlapping vendor relationships, shared ownership, or dual contracts. Evaluate procurement processes for fairness and independence. Document and review any existing partnerships that could compromise decision-making objectivity.

Mitigation and Oversight

Implement standardized reporting and disclosure processes company-wide. Assign leadership-level accountability to ensure transparency and enforcement. Use internal audits to evaluate the effectiveness of COI controls and compliance frameworks.

Common Mistakes and How to Avoid Them

Assuming Conflicts Are Rare

Some organizations rarely consider how to manage conflicts of interest, underestimating how often conflicts occur, which leads to unpreparedness. Encourage ongoing dialogue to ensure small ethical lapses are reported early.

Lack of Leadership Involvement

Policies fail when leadership doesn’t model compliance. Leadership plays a critical role in fostering a culture of openness. With transparency initiated at the top levels, employees are more likely to feel empowered to voice concerns and report potential conflicts. Leadership engagement is essential to establish and maintain credibility.

Inconsistent Enforcement

Your organizational conflict of interest mitigation plan won’t mean much if your business can’t uphold and enforce it. Selective enforcement breeds resentment and undermines trust in the process. Avoid this pitfall with a monitoring system to track disclosures, identify potential red flags in reporting, and document conflict of interest efforts when instances do occur.

Neglecting to Update Policies

Schedule regular periods of review for organizational conflict of interest policies to make any necessary changes and keep regulatory language as current as possible. Outdated policies fail to address modern risks like data privacy or remote contracting. Continuous review ensures COI management evolves alongside the organization.

Manage Your Conflicts of Interest with ComplianceBridge

The process of managing COI is tedious, but it’s also vital. Companies that master how to manage conflicts of interest and adhere to good COI practices can avoid fines, legal trouble, and other predicaments that can threaten the organization. Ensuring that the proper measures have been taken to reduce risks and manage potential conflicts can be a tedious process, but having the right tools can make it painless. Offering the flexibility to match your organization’s structure and needs, ComplianceBridge’s conflict of interest management software streamlines and simplifies the process of managing COIs—your disclosure process will practically run itself.

First, get started by creating custom question sets. Available question types include multiple choice, short answer, fill-in-the-blank, yes/no, and ranking. From there, you can weigh questions based on importance and add conditional follow-up questions that will only be shown to employees based on how they answered previous questions. This allows you to collect more detailed information concerning COI disclosures, which improves your reporting.

Tailoring the distribution of materials to certain personnel and delivering results in real time, ComplianceBridge provides an effective tool for maintaining ethical decision-making and a culture of integrity in the workplace. The best part of our COI software is that you won’t ever miss another collection period again. Just schedule the disclosure form to be sent to employees at the frequency of your choice, whether that’s biyearly, annually, biannually, or something more frequent.

After forms are distributed, automated notifications remind employees to complete their assignments, helping ensure nothing slips through the cracks. Meanwhile, our system tracks employee responses and participation in real time. The manager dashboard makes it easy to analyze trends, generate visual reports, and flag potentially problematic behavior. All data is securely stored in a centralized, cloud-based database with top-tier cybersecurity, creating a complete audit trail and supporting long-term compliance.

To learn more about how ComplianceBridge can help protect your business from the harms of organizational conflicts of interest at your company, request a demo today!